Attivismo civico & Terzo settore

The Grameen Bank opens in Italy

The world’s most famous village bank, the Grameen Bank, is set to open in Italy.

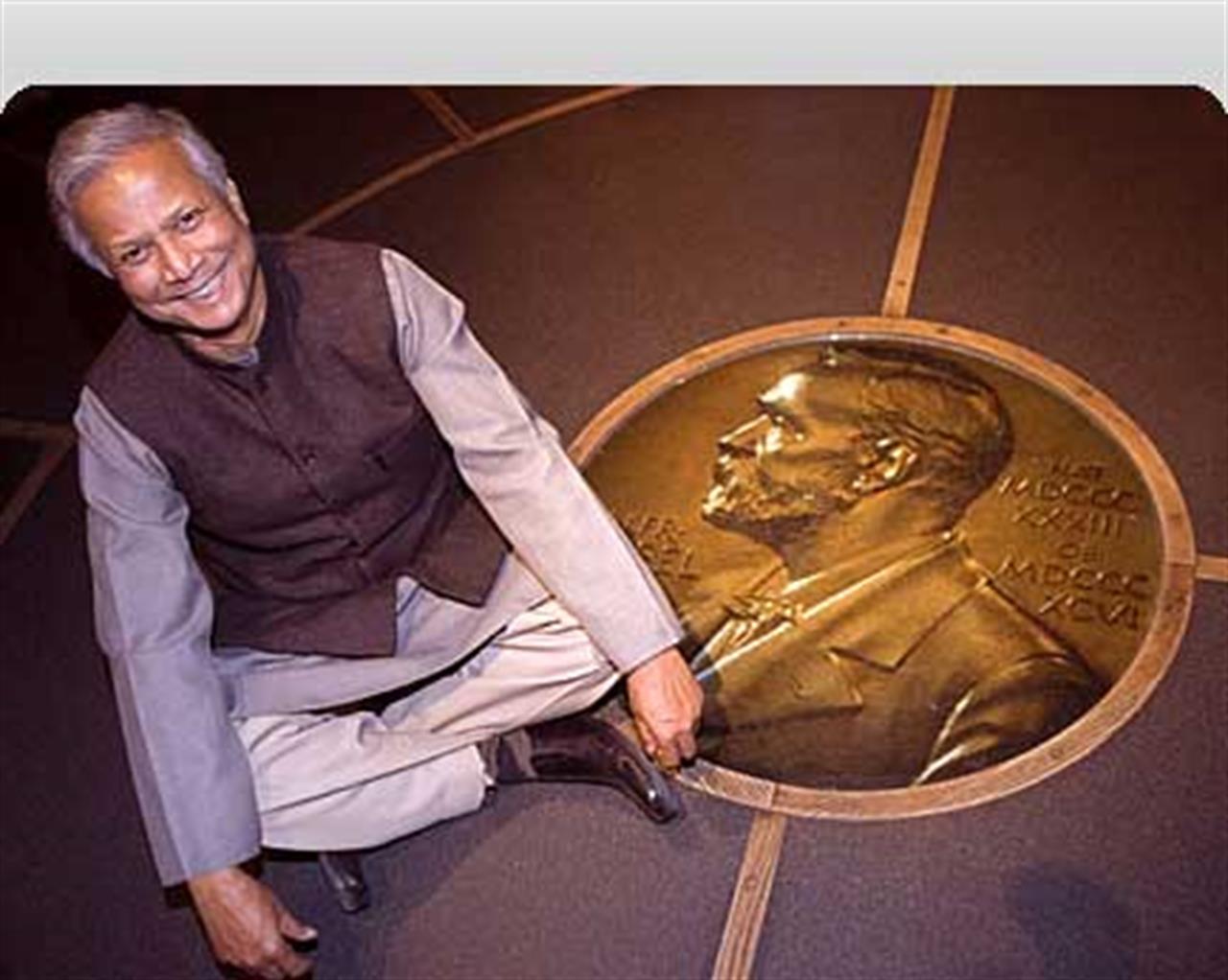

The announcement came on Monday 2 March in Milan during a debate at the Cariplo Foundation. “We are at the closing stages of the creation of an Italian branch of the Grameen Bank, a project that Unicredit, the University of Bologna and the Grameen Trust have worked together to set up”, said Nobel Peace Prize winner and founder of the world’s most famous microcredit bank, Muhammad Yunus. “We have recently also opened Grameen America in New York and are very satisfied with the result, it has been a real success”, he added.

The economic crisis? According to Yunus it is a unique opportunity to change the current system. “It is when things go wrong that we feel the need to change and I believe we can do this in a positive way”, he explained during his speech, which outlined his idea of “social business” as a remedy for the world’s ills.

“The theory of capitalism assumes that entrepreneurs are one-dimensional human beings, who are dedicated to one mission in their business lives − to maximize profit. This interpretation of capitalism insulates the entrepreneurs from all political, emotional, social, spiritual, environmental dimensions of their lives”. Upon this basis Yunus makes the claim that all the world’s social and economic problems will be addressed through social business. “The challenge”, says the banker, “is to innovate business models and apply them to produce desired social results cost effectively and efficiently”. His vision, he says, is of a “social consciousness driven private sector created by social entrepreneurs”, but how sustainable is such a vision?

If the Grameen Bank’s track record is anything to go by, very: a total of 7.59 billion dollars has been loaned to poor people, 97% of whom are women, in 83 thousand villages in Bangladesh. The repayment rate is an astounding 98.32% and, Yunus says, “Grameen Bank routinely makes a profit”. To the point that since 1995 it has become financially self reliant and not taken donor money to fund its activities.

“Grameen has given me unshakable faith in the creativity of human beings”, concludes Yunus, “let us join hands to give every human being a fair chance to unleash his or her energy and creativity”.