Individual

Both the Balkan Community Initiative Fund (BCIF) and the Technical Assistance to Civil Society Organisations TACSO project report that individual philanthropy is not a developed concept in Serbia. Miodrag Shrestha of the BCIF explains that this is due to several factors. First, the economic situation in Serbia is still quite poor. Furthermore, he says that due to several scandals in which foundations were caught embezzling funds individuals are sceptical and reluctant to donate their money. Another factor is that NGO staff often do not know how to organise fundraising campaigns. [1]

Corporate

According to the TACSO project the total amount of financial support for civil society from the business sector remains small, but there is a positive trend and an increasing number of businesses are supporting social organisations. USAID reported that recently a number of large foreign corporations, such as Philip Morris and La Farge, have begun to show interest in supporting Serbian social organisations. The TACSO project says that Serbian and foreign banks are among the most active corporate donors. At the local level a lot of support goes unrecorded. A lack of systematic monitoring of corporate support for social organisations means that total amounts offered by business are probably under- estimated. [4]

Tax Laws

Corporations may deduct up to 3.5 percent of their income for “medical, cultural, educational, scientific, humanitarian, religious, environmental protection and sport purposes.” With the exception of donations for humanitarian purposes, corporations may claim deductions regardless of whether they engage directly in those activities or donate to a qualifying recipient (NGOs and public institutions alike). In addition, corporations may deduct up to 1.5 percent of income for “investments in cultural purposes.” The Law does not specify whether corporations may claim deductions if they engage directly in cultural activities (Article 15, Law on Enterprise Profit Tax).The Personal Income Tax Law does not address charitable contributions. [7]

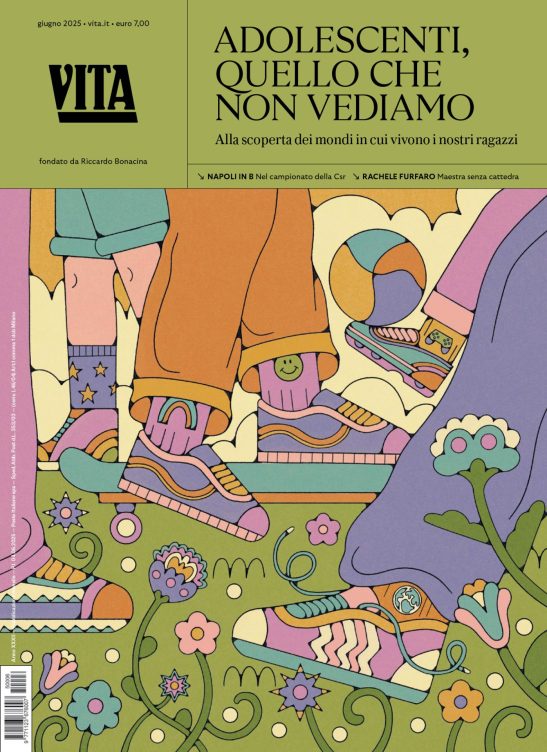

Cosa fa VITA?

Da 30 anni VITA è la testata di riferimento dell’innovazione sociale, dell’attivismo civico e del Terzo settore. Siamo un’impresa sociale senza scopo di lucro: raccontiamo storie, promuoviamo campagne, interpelliamo le imprese, la politica e le istituzioni per promuovere i valori dell’interesse generale e del bene comune. Se riusciamo a farlo è grazie a chi decide di sostenerci.